last day to pay mississippi state taxes

You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or eCheck. Penalties following the Feb.

Income Tax Elimination In Discussion At State Capitol

The administration previously said the credit would be a refund of approximately 13 of their 2021 state income tax liability.

. You will be taxed 3 on any earnings between 3000. Doris Spidle Tax Collector 500 Constitution Ave. Box 5205 Meridian MS 39302.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the item or provides a reduced rate of tax for an. Mississippis income tax ranges between 3 and 5.

To make payments without a penalty. Pay by credit card or. People who owe money on their 2021 property and land taxes have until Monday Feb.

Mississippi State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state unemployment tax in full and on. An instructional video is available on TAP. If the proposal is passed the bill would immediately eliminate income tax for people.

Mississippi also has a 400 to 500 percent corporate income tax rate. Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent. Mississippi is trending towards ending personal income tax and increasing state sales tax.

The median effective tax rate is somewhat higher than the national. In March the state moved the deadline to file and pay 2019 individual income tax to May 15 2020. Alaskan property tax due dates are September 15 for the first and November 15 for the second instalment.

The state uses a simple formula to determine how much someone owes. August 1 st - Publication fee 3 will be added to taxes owed for advertising the lien in the paper Last Monday of August - The Property lien will be auctioned at the Annual Sale of Delinquent. Thats just an estimate however -- it wont be finalized.

Mississippi State Taxes on US. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income. Learn more about Mississippi Military Retired Pay Income Tax Exemption.

Training any part of which occurred during the period. 1 at 5 pm. You can make electronic payments for all tax types in TAP even if you file a paper return.

WASHINGTON The Internal Revenue Service today reminds taxpayers who requested an extension to file their 2021 tax return to do so by Monday October 17. Detailed Mississippi state income tax rates and brackets are available on. Cre dit Card or E-Check Payments.

If someone makes less than 5000 they pay a minimum. First quarter 2020 Mississippi estimated tax payments were also extended to May 15.

Estimated Tax Payment Due Dates For 2022 Kiplinger

How To File And Pay Sales Tax In Mississippi Taxvalet

Mississippi Tax Rate H R Block

Mississippi Income Tax Reform Details Evaluation Tax Foundation

Mississippi State Tax Payment Plan Details

Mississippi State Tax Updates Withum

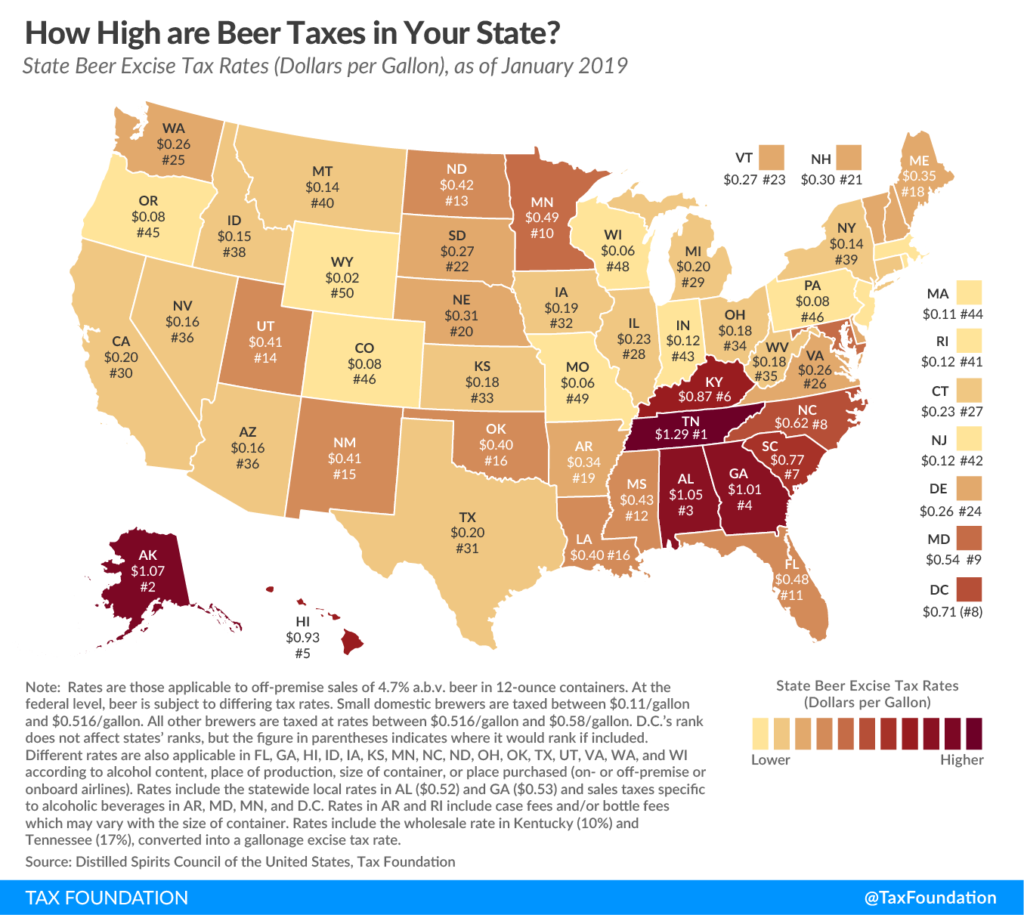

Mississippi S Beer Taxes Among Highest In The Country Mississippi Center For Public Policy

Ganucheau Mississippi S Three Republican Parties And How They Influenced The Income Tax Debate Press Register

Mississippi State Income Tax Ms Tax Calculator Community Tax

As More Americans Move To No Income Tax States More Lawmakers Move To Phase Out State Income Taxes

State Income Tax Return Filing Date Has Been Extended

How To File And Pay Sales Tax In Mississippi Taxvalet

Mississippi Income Tax Calculator Smartasset

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Overview Of Options For Taxpayers With Mississippi State Back Taxes

Mississippi Sales Tax Small Business Guide Truic